Homeowners may receive flood insurance perks, and developers can take preventative measures against flood risks after engineers studied flood zones in Oviedo recently.

Oviedo has been a member of the FEMA National Flood Insurance Program and participated in its Community Rating System since 2008.

When communities go above and beyond in sharing flood information with FEMA, residents and businesses, the effort is recognized with discounted premiums for NFIP members, according to FEMA’s Coordinator’s Manual.

The voluntary membership currently reduces some flood insurance policy premiums by 20%, according to the City of Oviedo.

The manual explains different activities a city can do to move up in its Community Rating System class. Classes are decided by collecting and improving flood information.

Oviedo Stormwater Coordinator Amanda Kortus said the city is ranked higher than most members as a CRS Class 6, offering a 20% premium discount for some residents, whereas moving to a Class 5 would offer a 25% premium discount to residents. In both classes, residents with the NFIP outside of hazard areas can get a 10% discount.

“…it benefits our residents and it benefits the city,” Kortus said.

Assistant City Engineer Paul Yeargain said the overall fee to the city for the cost of the project is approximately $90,000. That cost will not be aided through the state, he said.

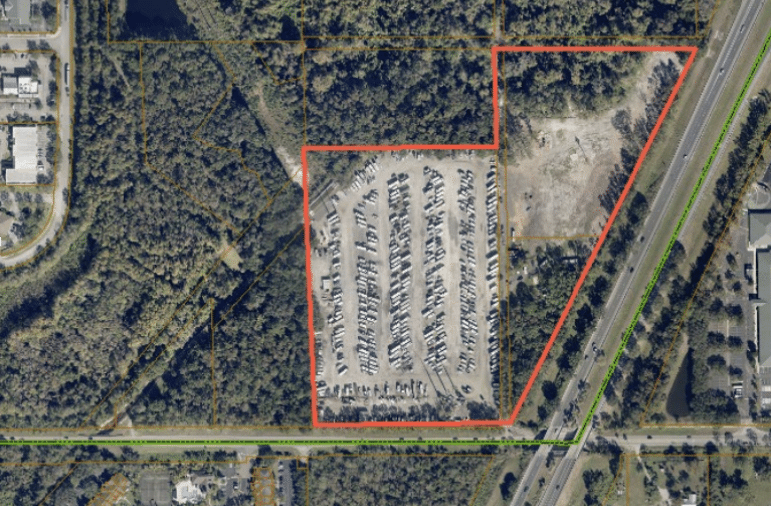

In the recent revision, areas with terrain likely to aggravate flooding, or Special Flood Hazard Areas (SFHA), were studied. These are areas a community must regulate under NFIP, according to the FEMA Coordinator’s Manual.

Now that the zones have been evaluated, and a required Letter of Map Revision was sent to FEMA and approved, the zones will be updated for property owners and insurance companies on Aug. 15, Kortus said.

OCN asked local insurance agencies about the importance of that evaluation and revision process for homeowners. John Canonico, owner of the Oviedo-Winter Springs Office of Brightway Insurance, said years ago houses next door to each other were offered the same premiums, but today those same homes could have different rates if there is a difference in elevation factored in.

“A lot is changing in the way that they are rating,” Canonico said. “We’re seeing premiums continue to go up in Florida because we used to have the most subsidized premiums in the country, and people who were paying $450-$500 are now paying $2,000-$3,000.”

All unevaluated independent floodplains in the city together total approximately 100 acres, Kortus said. However, not all of these zones were revised in the recent request to FEMA and there will still be unevaluated flood zones still left near homes.

A misunderstood risk

Only 17.37% of homes in Florida have flood insurance through the National Flood Insurance Program, according to 2023 data by insurance industry analyst Policygenius. But that low number is also the second highest in the country. In Minnesota, the least insured, fewer than 1% of homes are flood insured.

That extra flood insurance is usually necessary on top of homeowners insurance policies.

“Most homeowners insurance policies do not cover flooding,” according to the City of Oviedo website.

Canonico said that it is surprising how many people think flood coverage is included in their home policy and even more disturbing that many do not know what qualifies as a flood.

“Most people, when they think flood, they think water, water damage, and water damage is not always flood, flood is rising water,” he said. He said rain water entering a home from the roof or a pipe bursting does not count as a flood.

Part of the reason why flood coverage is a separate policy from home insurance is because people commonly switch homeowners insurance but don’t have to switch their flood insurance if it is not included, Canonico said.

“Having the separation can at times be in the client’s best interest.”

Kortus said 312 letters were sent this year to realtors and property owners in SFHAs, communicating when a property’s location is in a flood zone and prompting the of purchase flood insurance.

According to the FEMA NFIP, “Just one inch of water can cause $25,000 of damage to your home.”

Canonico said he often has buyers that choose not to purchase flood insurance because realtors tell them they are not in a flood zone.

“All of Florida is a flood zone,” he said. “It’s just some areas are more likely to flood and some are less likely to flood.”

Sorry for the interruption but please take 1 minute to read this. The news depends on it.

Did you know each article on Oviedo Community News takes anywhere from 10-15 hours to produce and edit and costs between $325 and $600? Your support makes it possible.

We believe that access to local news is a right, not a privilege, which is why our journalism is free for everyone. But we rely on readers like you to keep this work going. Your contribution keeps us independent and dedicated to our community.

If you believe in the value of local journalism, please make a tax-deductible contribution today or choose a monthly gift to help us plan for the future.

Thank you for supporting Oviedo Community News!

With gratitude,

Megan Stokes, OCN editor-in-chief

Thank you for reading! Before you go...

We are interested about hearing news in our community! Let us know what's happening!

Share a story!